News

Navigating Turbulence: Insights into the Geosynthetics Industry in 2024

Authors

By GNA Editor | 2nd April 2024

Outlook for Geosynthetics in 2024: Navigating Uncertainty with Positive Prospects

For the geosynthetics industry, there is great promise in 2024. In many ways, it is returning to a pre-pandemic kind of normal, especially when it comes to manufacturing and sales.

The new normal that is settling in brings with it new expectations and uncertainties.

GNA Editor has talked with industry experts as they examine what lies ahead in 2024 as well as reflect on the trends and events that shaped 2023.

As the geosynthetics industry steps into 2024, there is a sense of cautious optimism coupled with a recognition of the challenges that lie ahead. After grappling with the disruptions caused by the pandemic, the sector is gradually returning to a semblance of normalcy in terms of manufacturing and sales.

It is shaping up to be a turbulent year for geosynthetic companies installers and major producers alike, with potentially significant shifts in strategic playbooks. So, what are the five big themes to watch?

- Less Consolidation but market expansion by smaller players: One prominent theme for the industry in 2024 is less consolidation. Further consolidation is not on the agenda for the geosynthetics industry. Interest rates are high, capital is harder to secure, debt is risky, and major deals (e.g. Tensar, TenCate/Propex, Maccaferri) have been concluded in recent years. Perhaps there may be some small, regional consolidation, but unlikely. An emerging trend is smaller regional producers trying to move beyond their domestic markets (Indian & Chinese producers in particular, but also other regions like Middle East producers, Eastern European etc) – i.e more competition, fragmentation before the next wave of M&A in a few years.

- Sustainability: With increasing emphasis on environmental consciousness, sustainability remains a top priority for geosynthetic companies. In 2024, there is a concerted effort to adopt eco-friendly practices across the value chain, from raw material sourcing to product manufacturing and end-of-life disposal. As stakeholders demand greener solutions, companies are innovating to develop sustainable alternatives such as greener and biobased resins that minimize environmental impact without compromising performance.

- Resurgence of Growth: Despite the uncertainties looming on the horizon, there is a resurgence of growth within the geosynthetics sector. As infrastructure projects gain momentum and demand for construction materials rebounds, companies are cautiously optimistic about expanding their market share and capturing new opportunities. However, amidst the resurgence, companies are mindful of maintaining financial stability and mitigating risks in what promises to be a turbulent year.

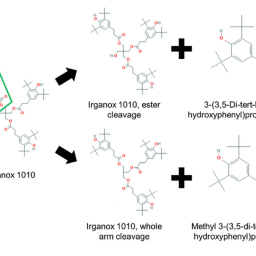

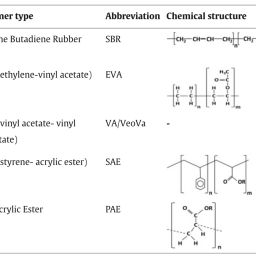

- Technological Advancements: In an era of rapid technological advancement, innovation remains a driving force in the geosynthetics industry. Companies are investing in research and development to enhance product performance, durability, and versatility with functional additives such as graphene and nanocomposites. From advanced materials to digital solutions for project management and monitoring, technological innovations are reshaping the landscape of geosynthetic applications and paving the way for more efficient and sustainable solutions.

- Adaptation to Market Dynamics: As the geosynthetics industry navigates through dynamic market dynamics, companies are compelled to adapt and evolve their strategic playbooks. From changing regulatory landscapes to shifting consumer preferences, agility and flexibility are essential for staying ahead of the curve. By embracing innovation, diversifying product offerings, and forging strategic partnerships, companies can effectively navigate the uncertainties and capitalize on emerging opportunities in 2024.

In conclusion, the geosynthetics industry is poised for a transformative year in 2024, marked by consolidation, sustainability, growth resurgence, technological advancements, and adaptation to market dynamics. While challenges and uncertainties abound, proactive measures and strategic initiatives can position companies for success in an increasingly competitive landscape. By embracing change and leveraging opportunities, the industry can chart a course towards sustainable growth and resilience in the years to come.

The geosynthetics market in 2024 hinges on the growth trajectories of four key sectors:

- Transportation Infrastructure: While Europe witnesses a decline, North America shows sluggish growth with prospects of improvement in repair and maintenance activities. Conversely, other regions exhibit moderate growth potential.

- Water Management: This sector presents significant growth opportunities across all regions, driven by the imperative need for effective water channeling, containment, and retention solutions.

- Environmental Protection: Growth prospects remain subdued except for the closure of landfills in Europe and North America, highlighting the ongoing need for sustainable waste management practices. Also pumped hydro schemes are the new renewable energy trend that relies of geomembranes to create impermeable dams.

- Mining: With major growth prospects in regions like South America, Asia, and Africa, driven by the demand for minerals essential for electrification, the mining sector emerges as a significant driver for geosynthetics demand.

1 minute Takeaways:

- The largest impact in 2023 on the geosynthetics industry was shipping costs/disruptions and shipping container availability.

- While we have returned to a “new normal” in 2024 the biggest likely factors are creating both longer term opportunities and short-term risks. Global climate change will drive infrastructure development and relocation or strengthening of existing infrastructure. We see geosynthetics playing a key role in these types of projects. Conversely, climate change and in particular increasing intensity and frequency of major weather events, will potentially have significant effects on the supply chain. This has been witnessed in the past with major resin manufacturers shut down as a result of storms.

- There will continue to be a focus on sustainability with research into the use of recycled materials, however across the industry, the general move is toward offsetting emissions and the development of “green” resins and circular economy resins (made from pyrolysis-derived naphtha).

- Geopolitics is currently disruptive – sanctions & trade barriers ([local, regional and global all exist and are growing), ocean freight costs & times, oil price volatility, China vs USA, wars etc.

- Sustainability is a big influence especially in Europe, and debt markets are demanding it. Western multi-national corps (MNCs) are driving this agenda internally.

- Geosynthetic industry will leverage AI by using big data from process and quality control parameters and use for machine learning and predictive quality assurance.

- As we are quarter of the way into 2024, the global geosynthetics market finds itself amidst a landscape of continuing uncertainty, yet with promising prospects on the horizon. Reflecting on the past year, 2023 saw varied performance across different regions, with Asia Pacific and the Middle East meeting expectations while Europe experienced a slight shrinkage in the market, accompanied by downward pressure on prices. Looking ahead, the forecast for 2024 suggests a mixed bag of challenges and opportunities, shaped by economic, environmental, and geopolitical factors.

- The International Monetary Fund (IMF) paints a sobering picture for the advanced economies, with a projected growth rate of 1.5%, indicating a continuation of sluggish performance. Although the global forecast stands at 3.1%, it falls short of the century’s long-term trend. Notably, the USA and key emerging markets like India and China demonstrate resilience, albeit against a backdrop of ongoing challenges. Inflation risks are mitigating, fostering hopes for a ‘soft landing’ despite persistently low productivity growth in mature economies. However, Europe continues to grapple with economic headwinds, indicating a prolonged struggle.

- The pursuit of economic growth has historically propelled the geosynthetics market forward. However, the landscape is undergoing a profound shift, marked by a heightened focus on environmental sustainability. Increasing global temperatures and the urgent need for climate adaptation measures underscore the critical role of geosynthetics in creating resilient infrastructure with a reduced carbon footprint.

- While economic uncertainties persist, the intersection of environmental imperatives and economic needs presents a momentous opportunity for the geosynthetics industry. Designers and stakeholders are increasingly seeking sustainable solutions, and geosynthetics emerge as a frontrunner in meeting these demands.

- In the dynamic landscape of 2024, the outlook for geosynthetics is characterized by a delicate balance of challenges and opportunities. As the world grapples with economic uncertainties and environmental imperatives, the role of geosynthetics in shaping resilient infrastructure becomes ever more crucial.

- 2024 is likely to see new ASTMs and GRI specs/standards launched such as the upgrading of GRI GM-13